Risk Profiling Suite

A modern advisory experience that captivates, empowering advisers to see around corners and build deeper client relationships, faster.

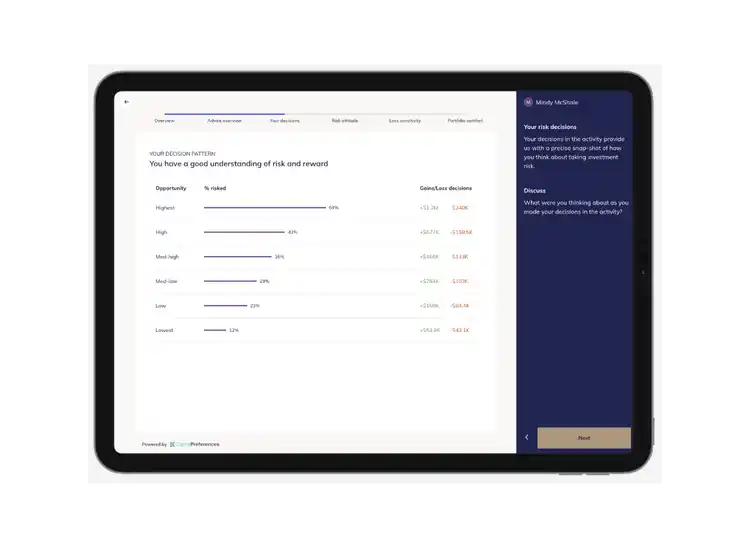

Start by engaging clients with an elegant digital profiling experience.

In two minutes, clients complete a gamified experience on their mobile device.

They prefer it 3:1 over conventional risk tolerance questionnaires, because it leads them to think more deeply about the risks they're willing to take.

Request a demo to discover how CP's Risk Profiling suite can modernize your advice experience.

Detect vulnerable clients

Use leading edge decision science to detect vulnerable clients with incoherent investing preferences.

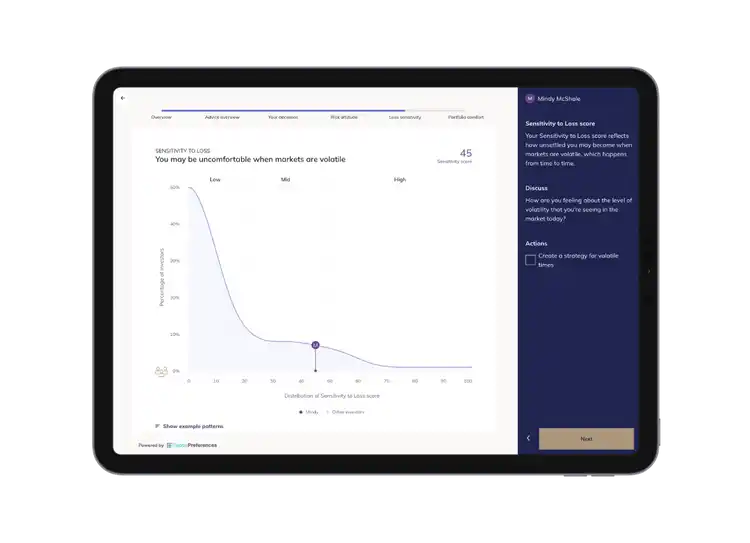

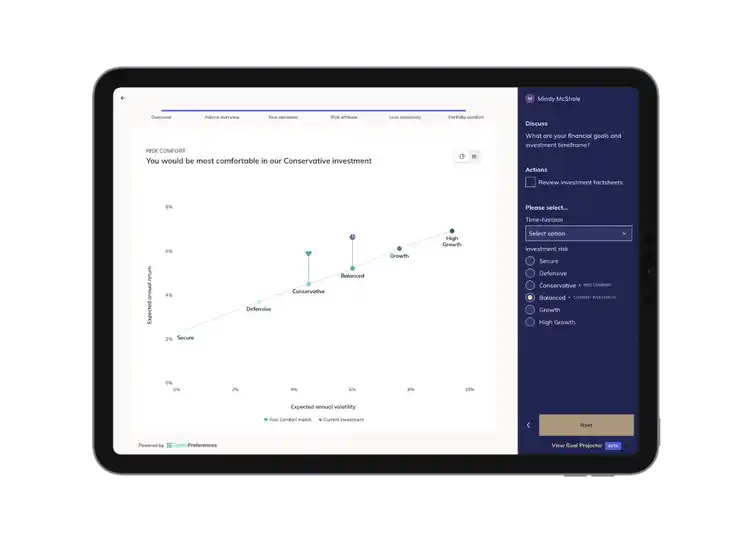

Meet compliance standards with science

Let economic theory and mathematics guide each client to their most suitable and optimal portfolio.

A risk profiling experience that treats partners equitably.

6 in 10 couples have meaningful differences in risk preferences.

90% of the time, advisers don't detect it.

Advisers who can connect the dots earn greater advocacy and higher loyalty.

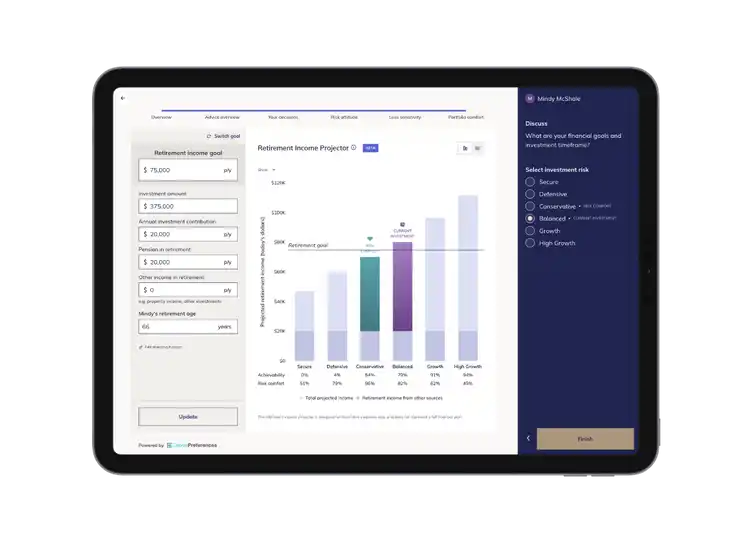

Modernise your annual review.

Short and engaging preference "pulse checks" deliver rich data and behavioral insights.

Level-up your annual reviews and spot new ways to create value for clients.